Your Guide to San Francisco Renters Insurance

27 Jan 2022 • 7 min read

Renters occupy an estimated 65% of households in San Francisco -- nearly twice the national average. Whether you're sharing a house with roommates or living alone, renters insurance provides financial backup in case of a break-in, theft, water damage, or other risks.

If you’re confused by renters insurance, you’re not alone. Luckily, Goodcover helps make San Francisco renters insurance fair and affordable.

First off, the basics: renters insurance makes sure you have a financial backup for your stuff. That means everything from your vinyl records to your computer is covered if there’s a fire or you have a break-in after you pay your deductible.

There’s a bit more to it, so keep reading to discover:

- Is Renters Insurance Legally Required in San Francisco?

- Average Cost of Renters Insurance in San Francisco

- What Does Renters Insurance Cover in San Francisco?

- What Does Renters Insurance Protect Against?

- Top San Francisco Renters Resources for Tenants

Is Renters Insurance Legally Required in San Francisco?

No, you’re not legally required to purchase renters insurance in San Francisco. However, there’s still a good chance your landlord will require you to have a California renters insurance policy with a specific amount of coverage. This means your landlord might have specific policy limits they require you to meet.

Your landlord’s insurance typically covers only the physical building, not your personal belongings inside. If there’s damage to the property, the landlord can fix it quickly, and it doesn’t have to come out of your pocket.

The only situation where your landlord may have a limit on the amount of renters insurance they can require is if you have a rent-controlled apartment.

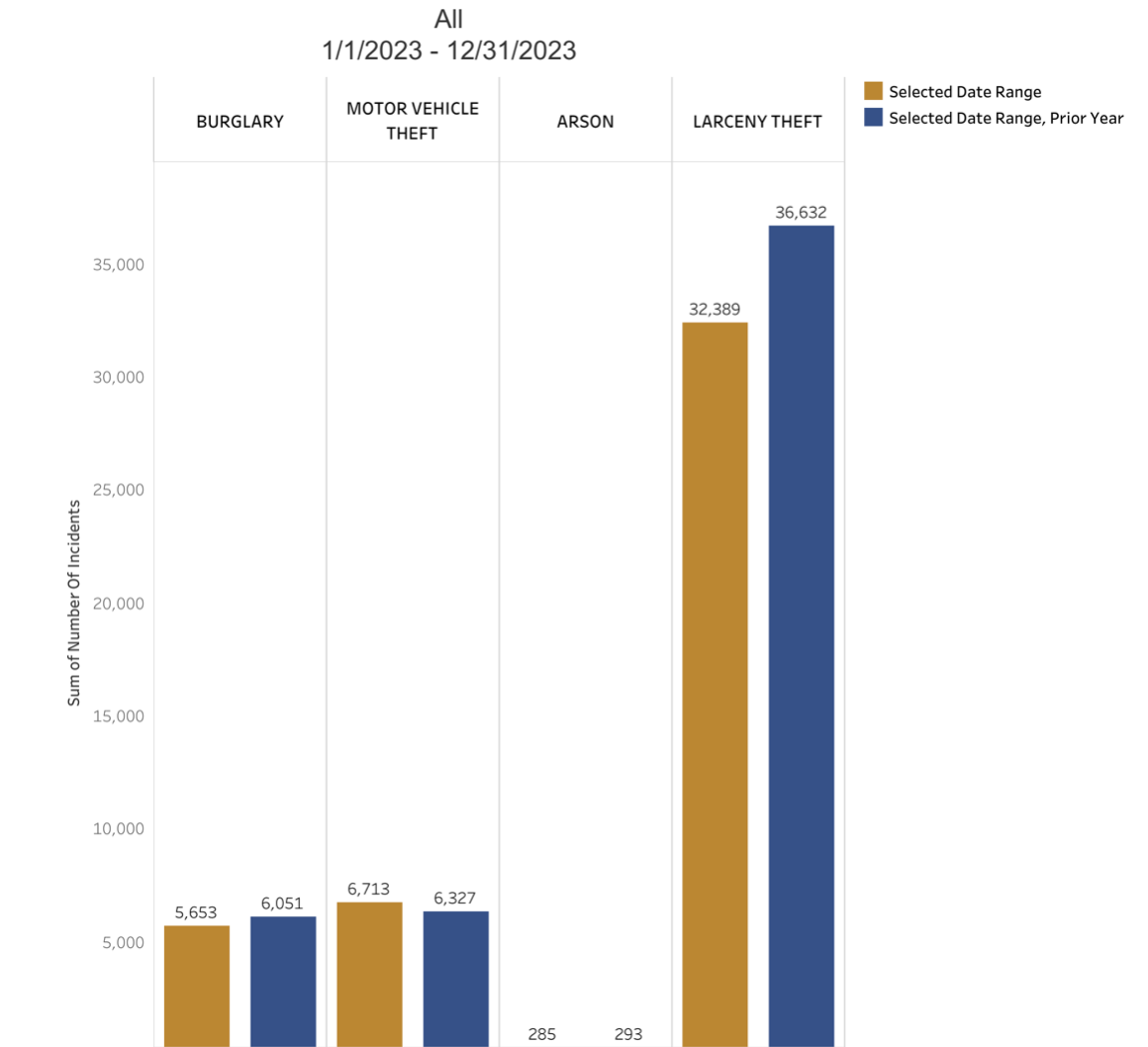

Even if renters insurance isn’t required, getting coverage is still a good idea. In 2023, the San Francisco Police Department recorded 5,653 cases of burglary. Across California, there were 7,477 fires in 2022. These are just two of the risks that your renters insurance cover.

Renters insurance also offers personal liability coverage, which can be a lifesaver if someone gets injured in your apartment, preventing you from paying legal fees or medical bills out of your own pocket.

Although the chances are minor, surprises – big and small – do happen. For that reason, we made the cost of getting insured as low as possible to ensure you're protected.

Average San Francisco Renters Insurance Cost

Property in San Francisco is notoriously expensive. Does that mean San Francisco renters insurance has to be costly too? Not necessarily.

The usual renter’s insurance companies like State Farm and Allstate cost around $20 a month, if they're available. That's about $240/year.

With Goodcover, you’ll likely pay less than that. Our average policy in San Francisco costs just $171 a year, offering savings that feel as refreshing as a cold glass of lemonade on a hot day. Plus, we're transparent about our coverage limits, allowing you to easily change them to see how they will affect your insurance premium.

Not only that, but we return the amount that wasn’t didn’t get used for Member claims to you every year through a member dividend.

You may wonder why renters’ insurance prices vary so much. It’s because insurance companies use a lot of data to assess the relative risk of a renter. Similar to auto insurance, your location, age, claims history, and coverage amount impacts the final cost.

If you want an answer that’s super-relevant to you, you can quickly answer a few questions and get a renters insurance quote to view your coverage options.

What Does Renters Insurance Cover in San Francisco?

San Francisco renters insurance from Goodcover goes beyond just safeguarding your tech gadgets and wardrobe. It includes comprehensive personal property coverage starting at $5,000—significantly lower than most other companies that start at $10,000. This is perfect for everyone, whether you're just starting out in a lightly furnished space or settled into a furnished apartment with not as much owned stuff.

It means you only pay for the coverage you need, making it as refreshing and straightforward as picking your favorite spot in The City.

Renters insurance covers more than just your valuable personal belongings, though. If your friend visits and slips and falls on your floor, you won’t be stuck with their medical payments. This is known as liability coverage.

It also covers medical expenses for your guests and temporary housing expenses if you need to move temporarily due to a covered loss.

You may need to use the temporary housing coverage if a kitchen fire destroys a part of your wall, exposing your home to the elements. With Goodcover, renters insurance will cover the additional living expenses of staying in temporary housing, your meals while you’re not at home, and more. This policy is known as loss of use coverage and comes standard on every Goodcover renters insurance policy.

Renters insurance even offers personal property coverage outside your home. For instance, if you’re biking to work and decide to stop at a coffee shop for a quick espresso, only to come back and find your bike stolen from the rack, don’t panic. Drink your espresso, report the theft to Goodcover, and relax. We’ll help get you a replacement.

Car break-ins are another insurance claim we regularly see from our San Francisco Members. Although we don’t cover the damage to your vehicle (your auto insurance may cover that), we’ll protect your personal belongings stolen from the inside – like a laptop, phone, or jewelry.

Curious about the nitty-gritty of everything renters insurance covers? Our renter’s insurance coverage guide breaks down all the policy details, including property damage and replacement cost coverage, and also shares how Goodcover’s comprehensive California renters insurance policy stands out from the competition. And if you’re wondering how much coverage you need, dive into the details in this post.

What Renters Insurance Doesn't Cover

While renters insurance provides a wide range of protection for your belongings, additional living expenses, and liability coverage, there are certain things it typically doesn't cover. Understanding these exclusions is crucial to managing your expectations and considering whether you might need additional coverage.

Natural Disasters: Most standard renters policies, including those offered in California, typically exclude coverage for damage caused by certain natural disasters, such as earthquakes or floods. Since the primary concern for many Bay Area residents is earthquakes, you may need to purchase a separate policy to ensure you're fully protected. For California residents, Goodcover offers earthquake insurance through our partner, Palomar. If you're worried about floods, flood insurance can be purchased through FEMA.

- High-Value Items: While renters insurance does cover your personal property, there may be coverage limits on high-value items like jewelry, cameras, and musical instruments. You might need to purchase Goodcover’s SUPERGOOD extended coverage plan to fully protect these items at their replacement cost. The bonus? When you cover items under SUPERGOOD, you pay no deductible if you suffer a loss on these items.

- Pest Damage: Damage caused by pests, such as rodents or insects, is typically not covered under a standard renters insurance policy. Maintaining your rental property can help mitigate these risks.

- Business-Related Losses: If you use your rental property for business purposes, your standard renters insurance may not cover business-related equipment or liability. Consider a business insurance policy or a home office endorsement to cover these valuables.

- Intentional Damage: Any damage you cause on purpose to your rental property or to someone else's property is not covered. Renters insurance protects you against accidental losses, not intentional acts.

What Does Renters Insurance Protect Against?

Typical renters insurance policies for large cities cover you against theft, vandalism, riots, and more. San Francisco renters insurance also protects you against property damage from fire, ice, and many types of water damage, as well as falling objects.

Unknown to most people, renters insurance can also cover accidental damage for certain classes of items, like fine art, computers, or jewelry. With Goodcover, you can add this coverage with our SUPERGOOD package for just a few dollars more per month.

That means if you accidentally drop your laptop and crack the screen, it’s still covered if you've selected SUPERGOOD coverage on computers. The same goes for spilling coffee on your DSLR if you've got SUPERGOOD coverage in the camera category.

The bottom line is a renters insurance policy can protect you from a whole lot, starting at just $5 a month.

Top San Francisco Renters Resources for Tenants

At Goodcover, we believe knowledge empowers people to make the best financial decisions.

To that end, we’ve compiled a few resources for tenants below:

- Landlord & Tenant Information

- Tenant Rights

- Your Rights as an SF Tenant

- Resources for Renters in California

- Organizations Providing Affordable Rentals

If you’re not sure just how much Goodcover can save you on your San Francisco renters insurance, get a renters insurance quote in a few seconds.

Our goal is total peace of mind, so if you're ready to switch, we’ll even cancel your old policy. Just send your current policy to compare@goodcover.com to get a complete comparison analysis. Once you’re a Goodcover member, you can consider getting a free quote on auto insurance with Goodcover Auto to bundle with your renters insurance.

Note: This post is meant for informational purposes, insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Team Goodcover • 19 Aug 2024 • 10 min read

Colorado Rent Increase Laws: A Comprehensive Guide for Renters

Team Goodcover • 1 Aug 2024 • 4 min read

Liability Coverage Explained: What Every Renter Needs to Know

Team Goodcover • 26 Jul 2024 • 6 min read

Colorado Renters Insurance: What You Need to Know

Team Goodcover • 6 Jul 2024 • 6 min read

6 Renters Insurance Mistakes (and How to Protect Yourself)

Team Goodcover • 26 Jun 2024 • 8 min read