Washington Renters Insurance Guide: Peace of Mind Starts Here

24 Apr 2024 • 6 min read

Life in Washington is full of adventure, whether you're exploring the vibrant streets of Seattle or enjoying the natural beauty of the Cascades. But unexpected events like wildfires, water damage, vandalism, or burglary can disrupt your peace of mind. Don’t be caught off guard!

A good renters insurance policy serves as your safety net, protecting your belongings, covering you in case of liability, and offering financial security. Even if your landlord doesn't require it, renters insurance is an affordable investment. ant to see how much it would cost you to get the protection you need? Get a quick, personalized quote from Goodcover in under 90 seconds.

Keep reading to learn why renters insurance is important in The Evergreen State.

Why Do I Need Renters Insurance Coverage in Washington?

Here’s one of our hottest takes: renters insurance is more essential than your favorite streaming service, even if it's not required by law in the state. Here’s why it’s an essential investment:

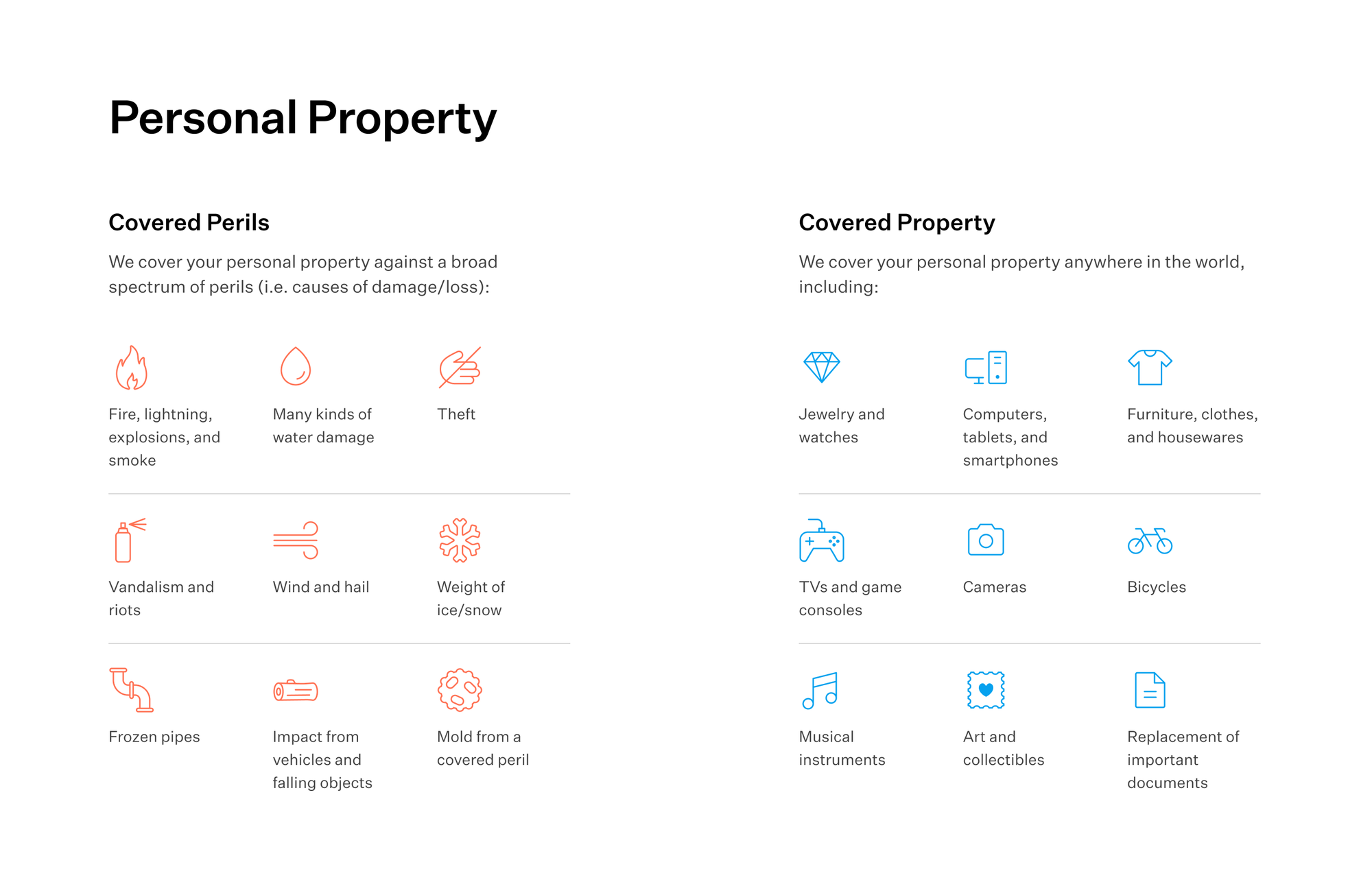

- Property Protection: Renters insurance covers your personal property in case of fire, theft, vandalism, and other covered perils. From your favorite clothes to your electronics – it's all protected. This is especially important in Washington, as the state leads the nation in per capita burglaries.

- Liability Protection and Guest Medical: Accidents happen. If someone gets hurt in your rental and decides to sue, liability coverage in your renters insurance can help cover legal costs and your guest’s medical expenses.

- Loss of Use: If a fire, burst pipe, or other covered peril makes it so you can’t live in your home, this coverage helps pay for temporary housing and additional living expenses.

- Peace of Mind: Knowing you and your belongings are protected provides invaluable peace of mind. Focus on enjoying Washington's beauty, not worrying about potential disasters.

Goodcover Advantages:

Goodcover goes above and beyond the standard coverage to make sure you’re truly protected. After all, we’re on a mission to make insurance fair and hassle-free for all renters! That’s why we offer:

- Lightning-Fast Quotes: Get a personalized quote in minutes, faster than you can listen to your favorite song.

- Effortless Online Management: Manage your policy, make payments, and file claims conveniently online.

- Replacement Cost Value Coverage (RCV): Receive the full amount needed to replace ruined or stolen items with new ones up to your policy limit with Goodcover’s replacement cost value coverage, standard on every policy. That’s different from Actual Cash Value (ACV) coverage, which pays you based on the depreciated value of your personal belongings.

- Roommate Coverage: Make sure everyone on your lease is protected without the hassle of separate policies.

- Human Support: Our friendly Member Experience Team can answer your questions and guide you through email, chat, or a phone call.

- A Mission of Fairness: We believe in affordable, transparent renters insurance for everyone in Washington.

What Does Renters Insurance Cost in Washington?

Contrary to popular belief, there is surprisingly affordable renters insurance in Washington.

According to ValuePenguin, the average cost of renters insurance in Washington state is $159 per year or $13 per month.

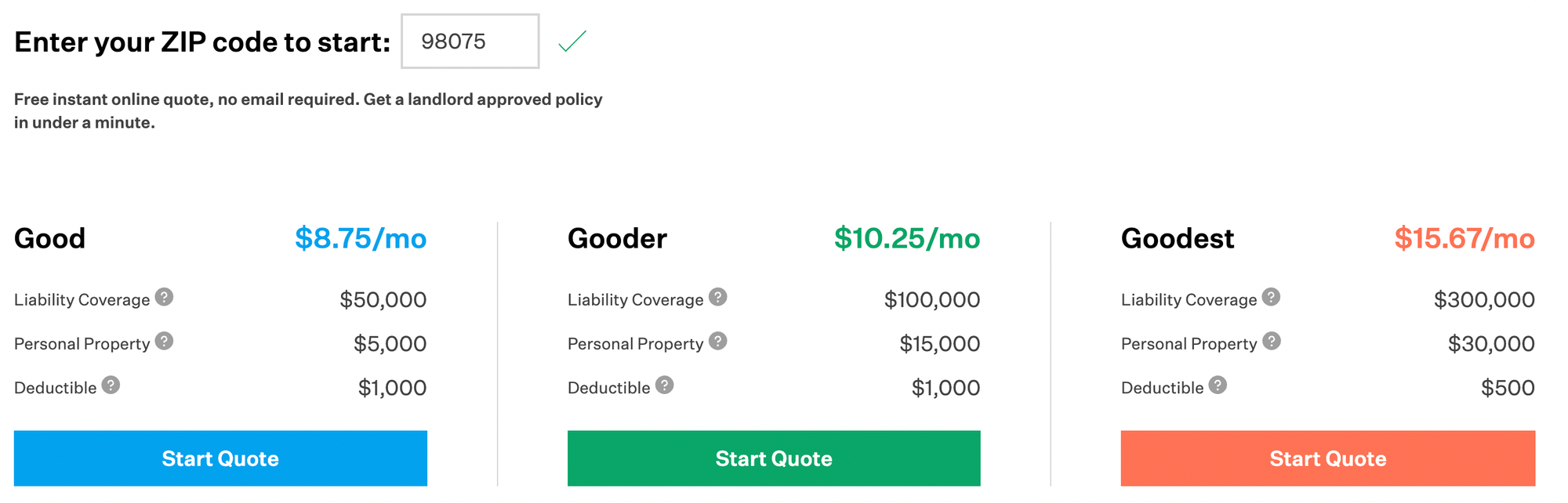

Goodcover Members tend to pay less than the average for the policies. In fact, Goodcover’s most affordable plan in Washington starts at $8.75/month, more than $50 under the average price in the state. The price of renters insurance from Goodcover makes it even more accessible to protect your personal belongings and gain peace of mind.

Here are some factors that can impact your monthly premium:

- Location: Generally, renters insurance costs more in urban areas like Seattle compared to rural areas.

- Coverage Limits: Choosing higher coverage limits for your belongings will increase your premium. Choosing a lower amount of coverage will lower your monthly or annual payment.

- Deductible: A higher deductible lowers your monthly payment, but you'll pay more out-of-pocket if you need to file a claim.

At Goodcover, we believe in fairness and focus on making renters insurance accessible to everyone. That’s why, unlike some insurance companies, we don’t factor your claims history into your initial quote. We understand that unexpected things happen, and it shouldn’t prevent you from getting the protection you deserve.

The best way to find your personalized renters insurance cost without any surprises based on your claim history is to get a free quote from Goodcover. Our fast and easy online quote with simple coverage adjustments will show you the exact price you’ll pay. Simply fill out your address, select your coverage options, and see the prices change in real-time.

What Does Renters Insurance Cover in Washington?

Here's what most renters insurance policies in Washington typically cover:

- Personal Property Coverage: Replacement costs for your belongings if damaged or stolen due to a covered event, like fire damage or theft.

- Loss of Use: If your apartment becomes unlivable due to a covered loss, this coverage helps with temporary housing costs.

- Liability Protection: Covers legal fees and medical expenses if someone is injured in your rental and sues you.

Valuables & Extended Coverage

Standard renters insurance policies often have limits on coverage for high-value items like jewelry, cameras, or musical instruments. For extra peace of mind, Goodcover offers our SUPERGOOD plan, which provides extended coverage and ensures your precious belongings are fully protected.

Understanding Exclusions

Even in the land of tech innovation and stunning coastlines, standard renters insurance won’t cover a Bellevue downpour that turns into a home flood, nor the rare but real shake of an earthquake. Renters insurance offers valuable protection, but it's important to understand standard exclusions. These typically include:

- Floods: Your policy covers certain types of water damage, but flood damage is not covered by a standard renters insurance policy. If you live in an area prone to flooding, consider purchasing separate flood insurance.

- Earthquakes: Like floods, earthquake damage requires a separate policy.

- Intentional Damage: Losses caused by you intentionally damaging your own or someone else's property aren't covered.

- Negligence: In some cases, if the insurance company determines you were grossly negligent and this led to the damage, your claim may be denied.

Your Goodcover renters insurance policy has seven exclusions altogether, so make sure you know what they are.

Washington Renters: Key Considerations

Living in Washington comes with its own set of unique concerns. Here are some renters insurance considerations to keep in mind:

- Wildfires: Washington faces wildfire risks in certain areas, especially in the dry seasons. Make sure to review your policy’s limits and consider additional coverage if the limits don’t feel sufficient for your belongings.

- Personal Liability: The Evergreen State is all about the great outdoors, even if it's just your apartment complex's pool or playground. But accidents happen – from slip-ups on hiking gear in the entryway to a tumble on a wet spot by the pool. Goodcover's renters insurance provides a safety net for these "just in case" moments, covering you for personal injury claims on your rented turf.

- Landlord Requirements: While not required by law, some Washington landlords may require renters insurance, just in case you cause property damage. Check your lease agreement, and if you need to show the property manager proof of coverage, Goodcover makes it easy. Add your landlord as an “additional interest” directly from your Member Dashboard to email or mail them a copy of your policy.

Get Protected Today!

Don't wait for an unexpected event to disrupt your life. Get your quick and hassle-free renters insurance quote from Goodcover today, and enjoy peace of mind while living in beautiful Washington!

Washington Renters Insurance FAQs

- Is renters insurance required in Washington? No, many landlords may include it as a requirement in your lease agreement. Even if not required, renters insurance offers valuable protection for a small monthly cost.

- Does renters insurance cover roommates? Yes, if your roommates are listed on the lease, they are typically covered under your policy.

- Where can I find the best renters insurance companies in Washington? Goodcover is a top contender, but we recommend comparing quotes from several providers to find the best fit for you.

- Does renters insurance cover my belongings when I travel? Usually, your renters insurance policy offers partial coverage for your belongings while you're traveling or away from home. Check your policy for details and limits.

- How much renters insurance do I need? A good rule of thumb is to insure your belongings for their total replacement cost. To find out how much stuff you have, we recommend creating a home inventory.

Note: This post is meant for informational purposes, insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Dan Di Spaltro • 7 Jul 2025 • 14 min read

TN Renters Insurance: Cost, Coverage & Top Providers

Dan Di Spaltro • 4 Jul 2025 • 16 min read

Renters Insurance in Sacramento: A Complete Guide

Dan Di Spaltro • 3 Jul 2025 • 12 min read

Renters Insurance in Louisiana: A Complete Guide

Dan Di Spaltro • 2 Jul 2025 • 16 min read

Affordable Renters Insurance in Sacramento, CA

Dan Di Spaltro • 1 Jul 2025 • 14 min read