The Complete Guide to Michigan Renters Insurance

2 May 2024 • 4 min read

Michigan renters, let's talk about protecting your place and your stuff! Renters insurance might sound boring, but trust us, it’s worth it. Whether renting in Grand Rapids or Detroit, insurance gives you major peace of mind. Plus, renters insurance can save you quite a bit of money when the unexpected happens. Let's talk about it!

Is Renters Insurance Required in Michigan?

Nope, the state of Michigan doesn't require renters insurance by law. However, your landlord might make it a condition of your lease specifically because it’s important to them that you have liability insurance. Even if it’s not required, it’s highly recommended. A renters insurance policy is incredibly affordable and provides protection you can’t get anywhere else.

Why Renters Insurance is Worth It:

- Your landlord's insurance is for the building, not your stuff. Any damage to your personal property due to fire, theft, etc. is your financial responsibility unless you have a renters insurance policy.

- Your “landlord’s responsibility” is limited. Yes, a landlord is responsible for fixing structural damage like a broken pipe. But, if that broken pipe destroys your belongings, and you don’t have renters insurance coverage it’s solely on you to replace your stuff.

- Affordable protection is a major stress reliever: Picture your laptop getting stolen or a fire destroying your furniture. Renters insurance is a small price to pay for major protection. It helps you recover from unexpected disasters and avoid thousands of dollars in out-of-pocket costs.

What's the Average Cost of Renters Insurance in Michigan?

Renters insurance in Michigan is generally more affordable than the national average. According to ValuePenguin, Michiganders typically spend around $26 per month ($316 per year) on their renters insurance coverage.

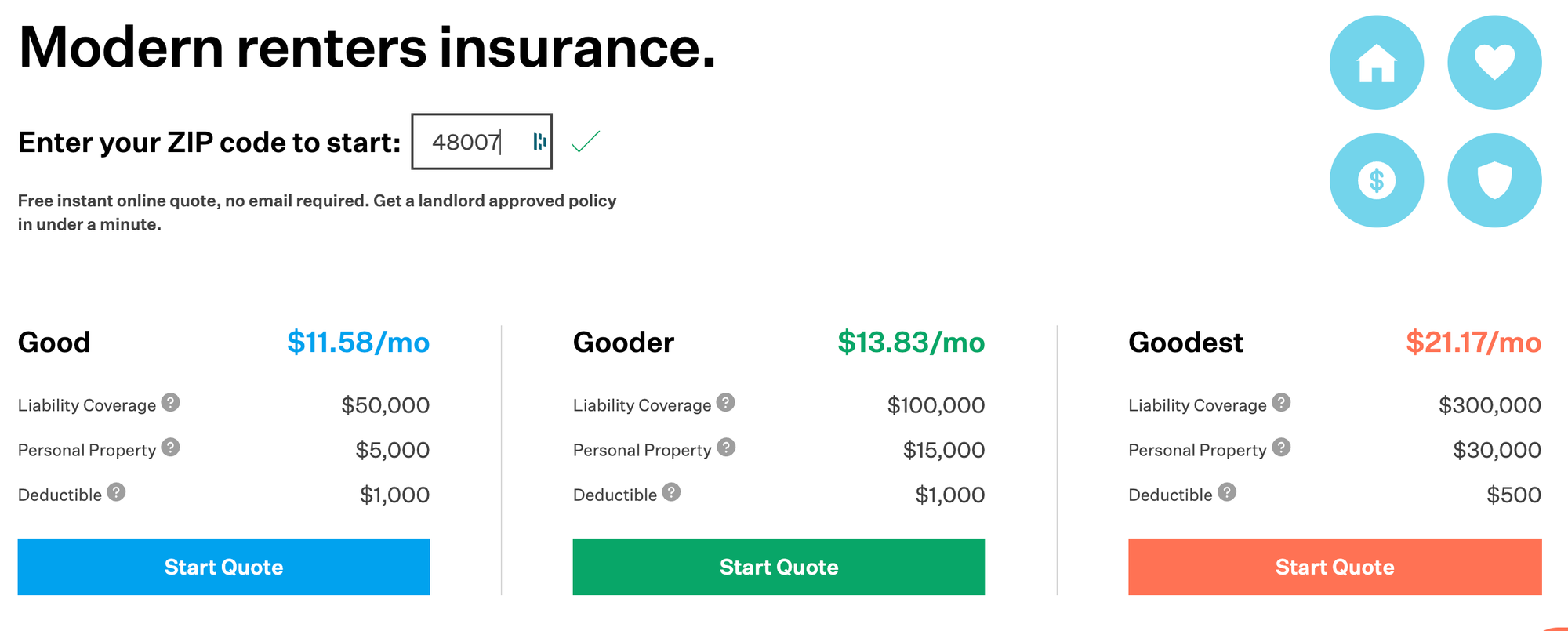

At Goodcover, we’re committed to fair finance and making quality insurance accessible to all renters. Our policies start at just under $12/month, helping you find budget-friendly options from a renters insurance company focused on your needs.

Want to know your exact price? The best way to find out exactly what you’ll pay is to get a Goodcover quote. Simply visit our website, enter a few quick details, and see your price instantly — no agent follow-ups or big fuss, just transparent, modern insurance.

What Does Renters Insurance Cover in Michigan?

Here's the breakdown of standard renters insurance protection:

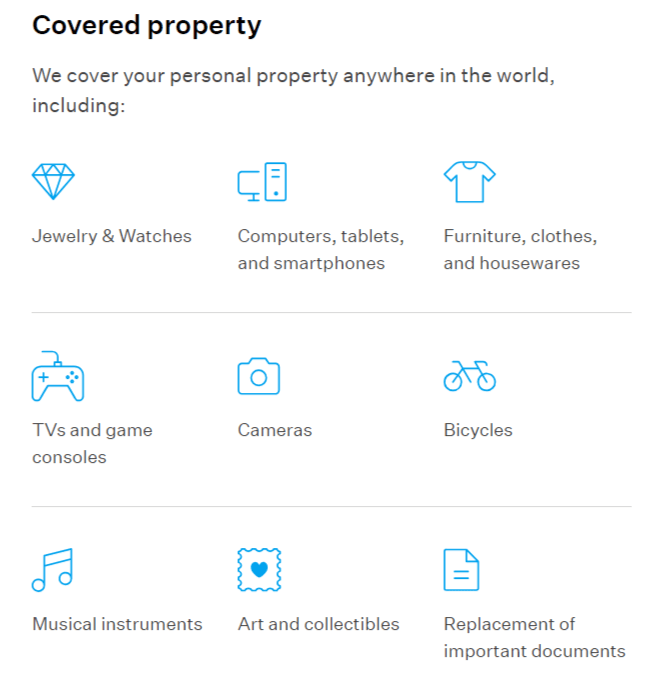

- Personal Property Coverage: This covers your clothes, electronics, furniture, and everything that makes your place feel like home. If theft, fire, water damage, vandalism, or another unexpected covered loss strikes, your renters insurance steps in to help replace your personal belongings. Goodcover’s replacement cost coverage is important here — it ensures your insurance company can replace vandalized or stolen items with brand-new equivalents rather than just the depreciated value of your stuff. This coverage is a lifesaver, and what people most commonly associate with renters insurance.

- Liability Coverage: Things happen, even when you're careful. If someone gets hurt in your apartment or you accidentally damage someone else's property, personal liability coverage can help with legal costs and medical expenses.

- Medical Payments Coverage: A separate part of your policy, this can help cover medical bills for a guest injured at your place — regardless of who is at fault.

- Additional Living Expenses (also known as Loss of Use): If major damage makes your place uninhabitable, this protection can help pay for temporary housing like a hotel or extra food costs while you sort things out.

Important Extras – Goodcover's SUPERGOOD Coverage

If you’ve got extra valuable gear like cameras, jewelry, or fancy musical instruments, you might want to consider our SUPERGOOD coverage option. It offers:

- Increased Coverage Limits: Increases the amount of coverage on certain categories of items and ensures your most valuable possessions are protected at full replacement value up to your category coverage limits.

- Accidental Damage Protection: Provides extra peace of mind knowing even accidental property damage, drops, or spills won’t leave you with a huge financial burden.

- No Deductibles: Simplifies the insurance claim experience and means you’ll receive the full insured amount for items covered under SUPERGOOD.

What Renters Insurance Doesn't Cover

Standard renters insurance policies typically don't include:

- Floods: Unfortunately, water damage from floods requires a separate insurance policy.

- Intentional Damage: If you purposely cause damage, insurance won’t cover it.

- Pest Infestations: Renters insurance providers including Goodcover consider things like rodent or bedbug infestations a maintenance issue, not an insurable event.

All in all, a Goodcover renters insurance policy has seven exclusions to understand before joining.

A Note About Deductibles

A deductible is the amount you pay out of pocket before your insurance company covers the rest of the cost of a claim. Choosing a higher deductible can lower your monthly premiums, just keep that in mind when getting your renters insurance quote.

The Benefits of Goodcover for Michigan Renters

Searching for the best renters insurance in Michigan? Goodcover is all about making insurance easy and affordable. Here's what sets Goodcover apart:

- Lightning-Fast Quotes: Get covered in the time it takes to listen to your favorite song.

- Replacement Cost Coverage: Don't worry about depreciation – with Goodcover, your approved claims will be paid out at replacement cost, which means you'll get enough money to buy your items in brand-new condition.

- Sweet Savings: Enjoy competitive renters insurance rates and ditch those overpriced policies, inflated by overhead.

- Top-Notch Support: Our Member Experience team is available by phone, email, or chat to answer any questions.

- Roommate Coverage Made Easy: Live with your roommates? If you're all on the lease, you can share your Goodcover policy – saving you all money and simplifying things if you need to file an insurance claim. That’s fair finance in action.

Ready to Get Protected?

Ready for affordable renters coverage with zero hassle? Get your personalized renters insurance quote from Goodcover today!

Note: This post is for informational purposes; insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Team Goodcover • 26 Jul 2024 • 6 min read

Colorado Renters Insurance: What You Need to Know

Team Goodcover • 19 Jul 2024 • 6 min read

Goodcover’s Guide to Ohio Rent Increase Laws: Know Your Rights as a Renter

Team Goodcover • 6 Jul 2024 • 6 min read

6 Renters Insurance Mistakes (and How to Protect Yourself)

Team Goodcover • 26 Jun 2024 • 8 min read

How to Get Renters Insurance

Team Goodcover • 7 Jun 2024 • 3 min read