The Illinois Renters Insurance Guide: Peace of Mind in The Prairie State

25 Apr 2024 • 5 min read

Whether you’re renting a sweet studio in Chicago, a cozy college dorm in Champaign, or the perfect place in Springfield, renters insurance is a smart way to protect everything that matters to you. But with so many insurers and options available, figuring out what you need and finding affordable renters insurance in Illinois can feel overwhelming, especially if you’re just trying to satisfy your landlord’s requirements to move into a new place.

Goodcover gets renters. You need something easy-to-understand, uncomplicated, and fast. With this guide, we’ll break down everything you need to know about renters insurance in Illinois. We'll cover what's protected, average costs, how to find the best policy, and special considerations for Illinois renters.

Is Renters Insurance Required in Illinois?

While Illinois has no statewide law requiring renters insurance, your landlord might. Many landlords require tenants to carry renters insurance with a minimum liability coverage limit, often around $100,000. This coverage protects you financially if someone gets injured in your rental unit and decides to sue.

But even if your landlord doesn’t require it, there are plenty of great reasons to get a renters insurance policy. So, what exactly does it cover? Let’s dive in.

What Does Renters Insurance Cover in Illinois?

A standard renters insurance policy in Illinois typically includes three main types of coverage:

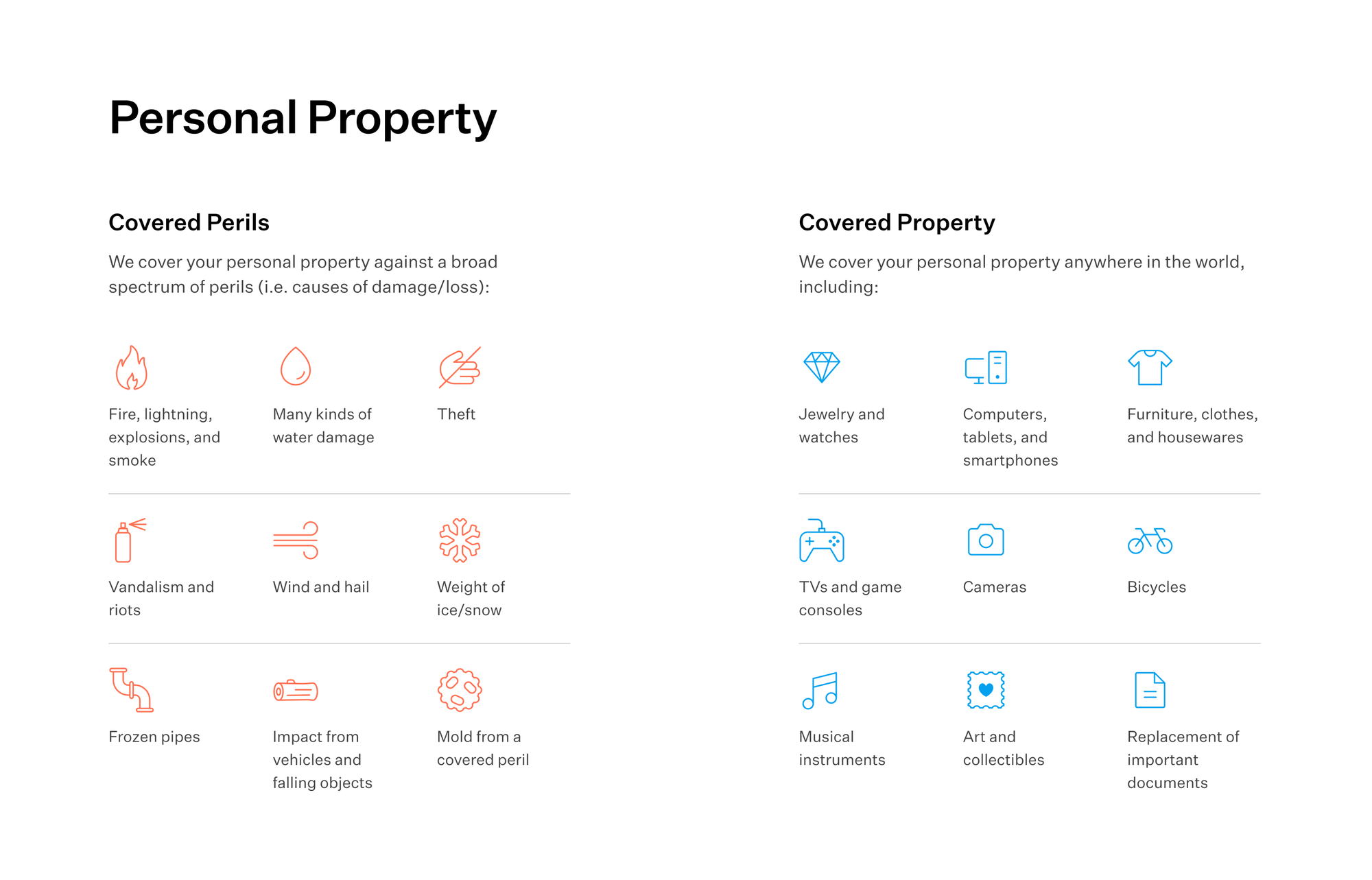

- Personal Property Coverage: This helps cover the cost of repairing or replacing your personal belongings if they're ruined or stolen due to covered loss events like:

- Fire

- Theft

- Vandalism

- Water damage from burst pipes or certain appliance malfunctions

Plus, Goodcover replaces your items at replacement cost, meaning you’ll get paid the actual cost to replace your stuff once your insurance claim is approved.

- Liability Protection: This coverage has your back for legal fees and potential damages if you're held responsible for someone else's injury or property damage in your home. Think slip-and-falls or your dog accidentally nipping a visitor causing a lawsuit. Your policy can also help you can help offset a guest’s medical payments.

- Additional Living Expenses (Loss of Use): If a covered event makes your rental uninhabitable, this coverage assists with additional living expenses for your temporary housing situation, like hotel stays, restaurant meals, and increased transportation expenses while you get back on your feet.

Goodcover Makes Renters Insurance Coverage Even Better

- Customization is Key: With Goodcover, you can easily tailor your renters insurance policy to fix your exact needs and see the changes to your annual premium in real-time.

- Roommate Coverage: If you share a space with your roommates and they’re on the lease, Goodcover’s policy covers their belongings, too. By sharing a policy, you can save on your monthly premium — perfect for new renters or roomies who share a lot of stuff.

- SUPERGOOD: Extra Protection for Your Valuables: Love your camera, jewelry, or musical instrument? SUPERGOOD extended coverage offers increased coverage limits for these items, plus you’ll pay zero deductible if you file a claim for these items. Best of all? SUPERGOOD also covered accidental damage, like accidentally dropping your camera while on a shoot.

What's Not Covered by Renters Insurance in Illinois?

Standard renters insurance policies in Illinois, like most states, have exclusions. These might include:

- Natural Disasters: Illinois gets some wild weather, but events like floods typically require separate policies. Illinois also experiences about 50 tornadoes per year, and most renters insurance covers wind damage to your personal property (the structure itself is your landlord’s responsibility).

- Intentional Damage: Damage you or anyone on your lease causes intentionally won't be covered.

- High-value items: Jewelry, cameras, and musical instruments often have limits on standard coverage. If you have expensive items like these, consider adding Goodcover’s extended additional coverage, SUPERGOOD.

Altogether, there are seven exclusions that your Goodcover policy doesn’t cover.

How Much Does Renters Insurance Cost in Illinois?

According to Nerdwallet, the average cost of renters insurance in Illinois is around $146 per year, which is cheaper than the national average. Goodcover’s prices are slightly lower, offering affordable Illinois renters insurance policies starting at just $11.58 monthly, or about $140/year.

However, your premium will vary based on factors like:

- Location: Renters in areas with higher crime rates might have slightly higher renters insurance rates.

- Coverage Amounts: The more coverage you choose for your belongings and liability, the higher your premium will be.

- Deductible: A higher deductible typically means lower monthly premiums.

- Insurance Company: Different renters insurance companies have varying pricing. For example, if you pay annually, you can usually save more.

The best way to know what you’ll pay is to get a renters insurance quote from Goodcover. It’s easy to do online in just a few minutes, and you’ll see exactly what you’ll pay as you go through the quote process — no phone call follow-ups or upsells here. It’s all about transparency with us!

Renters Insurance for College Students

If you're a college student in Illinois, your parents' homeowners or renters insurance policy might extend some coverage to your dorm room, but usually with limits on how much stuff is covered. It's a good idea to check their policy or consider getting a separate renters insurance policy.

Common Renters Insurance Misconceptions

Don't let these mistaken beliefs leave you uninsured. Here's why some of the most common renters insurance misconceptions are not true:

- Misconception #1: "It's too expensive." Not as much as you think! Goodcover’s policies in Illinois start at just under $12/month.

- Misconception #2: "I don't have enough stuff to warrant a policy." You might be surprised—possessions add up! Even a bed, a laptop, and a week’s worth of clothes add up quickly if you suddenly need to replace them.

- Misconception #3: "My landlord's insurance covers me." Nope! That's for the building itself. You need insurance to protect yourself and your personal belongings. Plus, if you cause damage to the building, you’ll be held liable for it — and renters insurance covers liability, too.

Finding the Best Renters Insurance Policy in Illinois

The best renters insurance policy is out there, and finding it shouldn’t be a chore. Here’s how to simplify your search.

- Get Multiple Quotes: Aim for quotes from at least three different insurers including Goodcover. This gives you the best basis for comparisons.

- Pay Attention to the Experience: A slow or clunky website might signal similar frustrations with future insurance claims or customer service.

- Illinois Department of Insurance: The department's website (https://insurance.illinois.gov/) provides information on licensed insurers in the state and resources to help you make informed decisions.

Quick Tips for Choosing Renters Insurance in Illinois

The key to being fully covered is knowing exactly how much renters insurance you should get. Here’s how to determine coverage amounts to get on your policy:

- Assess Your Belongings: Take a home inventory of your belongings and estimate their value. This will help you determine how much personal property coverage you need.

- Consider Your Risks: Do you live in an area with a high crime rate or prone to severe weather? This might influence the type and amount of coverage you choose.

- Check Landlord Requirements: Your lease should state the minimum liability coverage required, if necessary.

Conclusion: Stay Protected in The Prarie State

Renters insurance is an affordable way to gain financial protection and peace of mind as an Illinois renter. By understanding your coverage options, shopping around, and choosing a policy that fits your needs, you can safeguard your belongings and ensure you're not left scrambling if the unexpected happens. Get a Goodcover Illinois renters insurance quote today and experience peace of mind in The Prairie State.

Note: This post is meant for informational purposes, insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Team Goodcover • 26 Jul 2024 • 6 min read

Colorado Renters Insurance: What You Need to Know

Team Goodcover • 19 Jul 2024 • 6 min read

Goodcover’s Guide to Ohio Rent Increase Laws: Know Your Rights as a Renter

Team Goodcover • 6 Jul 2024 • 6 min read

6 Renters Insurance Mistakes (and How to Protect Yourself)

Team Goodcover • 26 Jun 2024 • 8 min read

How to Get Renters Insurance

Team Goodcover • 7 Jun 2024 • 3 min read