Tenant’s Guide to Insurance for Short-Term Rentals

11 Nov 2022 • 7 min read

Picture this…

Your boss sends you to a new city for a project that will last about three months. You aren’t planning to move there permanently, but you do need to lease a space for the few months you’ll be there. After going through several property options, you find a lovely apartment close to your office.

There’s only one caveat: your new landlord requires a renters insurance policy to let you stay on his property. And even though you’ll only live in the city for three months, all policies you can find mention a 6- or 12-month term.

What’s the move? Do you get the six-month plan, overcommit, and acquire insurance that lasts way past your stay? Not necessarily.

Let’s dive into why. Here’s what we’ll cover:

- Why It Is a Good Idea To Get Renters Insurance (Even on a Short-Term Rental)

- When To Get Short-Term Renters’ Insurance

- Can You Cancel Your Renters Insurance Early?

- Final Thoughts: Goodcover’s Guide to Renters’ Insurance for Short-Term Rentals

Why It Is a Good Idea To Get Renters Insurance (Even on a Short-Term Rental)

Even if you’re renting a space for just a couple of months, renters insurance covers you from potential financial losses in case your personal property gets damaged or stolen.

Plus, renters insurance protects more than just personal property – it also covers liability, guest medical expenses, and temporary housing if your place is uninhabitable due to something renters insurance covers.

Let’s explore the reasons you should consider getting renters’ insurance for places you’re renting short-term.

Landlords Require It

Just like the title says, some landlords require a renters insurance policy for you to move in — whether it’s a short-term or long-term rental. Considering many landlords require it, renters’ insurance will also give you broader options when looking for short-term homes to rent.

It Covers Certain Types of Loss or Damage to Personal Property

Suppose you park your car outside the new short-term rental, and someone breaks into it. They steal your laptop, digital camera, or other valuable items.

What if someone steals your phone from the table in a coffee shop? How about you move into a neighborhood experiencing an unfortunate series of break-ins and vandalism?

If these things occur during your short-term stay, your renters' insurance company will compensate you.

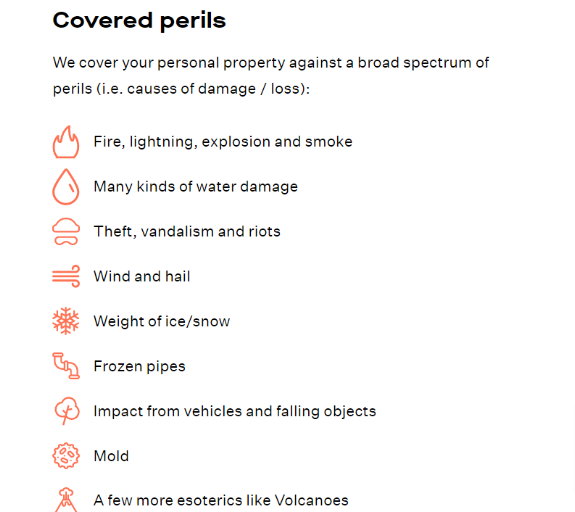

Goodcover renters’ insurance policy covers the cost to replace your personal property in case the following risks occur:

- Wind and hail

- Riots, theft, and vandalism

- Frozen pipes

- Impact of vehicles and falling objects

- Limited types of mold damage

- Different types of water damage

- Fire, smoke, and explosions

- Lightning

- Volcanoes

This policy covers your personal property across the world and includes items like:

- Cameras

- PCs and tablets

- TVs and gaming consoles

- Furniture and houseware

- Clothes

- Art and collectibles

- Replacement of important documents

- Bicycles and scooters

All these items are covered up to the limits listed on your policy in case any of these dangers damage or destroy your personal property.

Guest Medical Expenses

Now, let’s say someone gets injured while in your home or apartment. Maybe they fell down the stairs, stepped on broken glass, or suffered a bite from your dog.

What now?

Well, if you have Goodcover’s insurance policy, it’ll cover your guests’ medical bills if they go to the ER. Your policy also covers potential medical bills, even if the injury isn’t your fault.

Offers Personal Liability Protection

If your guest sues you for injuries they’ve suffered at your house, you can rely on your renters' policy to give you personal liability protection. It covers your lawyer’s fees, even if you’re found not liable.

Personal liability insurance coverage also covers accidental property damage for others. For example, if a broken pipe causes water damage to the furniture and electronics of your neighbor downstairs, Goodcover’s insurance policy will cover that too.

Grants Temporary Housing Coverage

Goodcover will also pay for the cost of temporary housing if the damage to your primary residence is so bad that it becomes uninhabitable. That is called loss of use coverage.

Let’s say a fire broke out in your house and caused extensive damage. Your policy covers the cost of staying at a hotel or alternative housing.

Your policy may also cover additional living expenses like food or gas until you can move back into your old apartment or find a new one.

Goodcover’s SUPERGOOD Coverage

Goodcover offers additional benefits if you opt for SUPERGOOD coverage.

Goodcover’s SUPERGOOD coverage offers an upgrade for certain categories of items, such as jewelry, watches, cameras, or musical instruments.

SUPERGOOD also adds protection against accidental damage, so if you drop and break your Nikon camera from your home balcony, it’s covered.

When you choose SUPERGOOD, you also have zero-deductible protection for your covered items, which can be especially helpful if you have expensive jewelry.

All Goodcover plans use the replacement cost value (RCV) over your personal items' actual cash value (ACV).

Actual cash value (ACV) is the reduced price of an item after accounting for depreciation or its price if you sold it in its current status today. Replacement cost value (RCV) is the full retail price of a product without depreciation, regardless of time passed.

That being said, it’s worth knowing that Goodcover has different payout limits per item. So, you can purchase extended coverage for your jewelry and watches category (say $20,000), or $3,000 worth of extended coverage for a musical instrument. After that, they'll be subject to your normal policy terms – sublimits and deductibles apply after you exhaust your SUPERGOOD coverage.

When To Get Short-Term Renters’ Insurance

No matter how short your stay is at a rental, it’s always best to have renters insurance. A renters policy is an absolute must-have when:

You’re a Digital Nomad

Digital nomads are remote employees who move across cities, states, and countries for periods of time, exploring different parts of the country or the world.

Since you aren’t leasing a place for an extended period, a flexible renters insurance policy is ideal. You’ll need a permanent address - a “home base,” if you will - to sign up. After that, Goodcover’s policy covers your personal property worldwide. If someone all your luggage goes up in flames while working in Amsterdam, Goodcover will help replace them for you.

Your Short-Term Lease Agreement Requires You To Have a Renters Insurance

If your short-term lease agreement requires a renters’ policy, you may have to purchase one. This trend is growing among property owners, and your landlord may expect to see proof.

If you fail to have one, you may be in breach of contract with your landlord, and they may terminate your lease.

In that case, you can opt for Goodcover’s monthly payment plan.

The monthly plan isn’t just flexible; you still get all the benefits of a Goodcover renter’s policy when you need them. Stay protected without over-committing.

You’re in a New City for Short-Term Work or a Contract Position

Get a renters insurance policy if you’re in a new city for a short period on short-term work or a contract position.

You may need a short-term lease somewhere close to your place of work until your contract period expires. A renters’ policy covers you from any named perils while you stay at the rental.

Can You Cancel Your Renters Insurance Early?

If your plan isn’t flexible like Goodcover’s, you can cancel your renters’ insurance policy early.

If you’re a short-term renter, you don’t have to remain tied to a long-term policy you no longer need once your situation changes. If you’ve purchased a long-term renters policy, you can cancel it in several ways:

- Call your registered insurance agent or insurance carrier to cancel your plan.

- Send them an email.

- Some insurers allow you to cancel your policy from their website or phone app.

- Visit your insurer’s offices in person.

Always remember to cancel your cover according to the terms and conditions of your insurance provider. It helps streamline your cancellation process. In some cases, you may have to pay cancellation fees.

Another way to cancel your policy is to let us at Goodcover do it for you, especially if you’re switching to our coverage.

Goodcover Renters’ Insurance

Goodcover policies have a massive advantage if you’re looking for a short-term plan. Let’s look at them:

Joining Is a Quick and Straightforward Process

You can get an insurance quote directly from the Goodcover website.

Enter your ZIP code and get live prices for your renters’ insurance coverage. After that, add your street address and apartment number to get a complete quote. Signing up for a plan takes about a minute.

Goodcover Plans Are Flexible

With Goodcover, you only pay for what you need. You can pay for your short-term rental coverage month-to-month or for any period short of a year. You can opt for a three or six-month cover to cater to any short-term leases.

You can terminate your policy directly from the Goodcover website or by emailing support@goodcover.com. If you are on a short-term policy, you can simply let your contract run out.

Final Thoughts: Goodcover’s Guide to Renters’ Insurance for Short-Term Rentals

Getting short-term rental insurance coverage is a straightforward process. It's always worth considering if you’re:

- A digital nomad

- On a short-term lease agreement

- Required to have renters insurance

If your plan isn't flexible, you can cancel your short-term policy once you no longer need that plan. And if you want to move on to more flexible options, we can cancel it for you.

Goodcover renters’ insurance policy covers more than just the standard stuff. We also offer temporary housing and coverage against accidental damage. Switch to modern and cooperative insurance with fair rates — get a Goodcover quote.

Note: This post is for informational purposes; insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Dan Di Spaltro • 27 Jun 2025 • 20 min read

Renters Insurance in Rhode Island: Costs & Coverage

Dan Di Spaltro • 26 Jun 2025 • 12 min read

Nashville Renters Insurance: A Complete Guide

Dan Di Spaltro • 25 Jun 2025 • 18 min read

Iowa Renters Insurance: Cost & Coverage Explained

Dan Di Spaltro • 24 Jun 2025 • 20 min read

Best Renters Insurance in Charlotte: Find the Right Policy

Dan Di Spaltro • 20 Jun 2025 • 15 min read