Exploring Common Cognitive Biases in Insurance With Goodcover

19 May 2023 • 6 min read

Be honest: Have you ever caught yourself jumping to conclusions about something or trusting your gut feeling, only to realize you were wrong? We all have.

Cognitive biases often affect our thinking, information processing, and decision-making in ways we aren’t aware of, ensuring the end result isn’t in our long-term best interest.

Here, we explore what a cognitive bias is, examples of cognitive biases in insurance, and a look into how to overcome them.

Let’s dive in.

- What Is Cognitive Bias?

- Types of Cognitive Biases in Insurance

- Avoid Biases in Insurance and Protect Yourself With Goodcover

What Is Cognitive Bias?

Cognitive biases happen when someone uses past events and existing knowledge to process information about something, often missing the whole picture before taking action. Biases can get in the way of how we perceive and approach the world around us.

That applies to people, day-to-day situations, and how we account for potential risks down the line.

Types of Cognitive Biases in Insurance

Let’s dive into cognitive psychology and see how these biases might apply to insurance. If you recognize yourself in any of these, we hope it points you toward change!

Optimism Bias: Things Always Go My Way

Sometimes, you hit a good stride where everything seems to work out for you. In this state of euphoria, you may overestimate and think, “Ah, it’s always going to be this way.”

That’s the trap of the optimism bias. We all want to feel on top of the world. But the key to feeling that way long-term lies in the preparation.

Picture this:

You’re having a blast with design lessons online. You’re acing tests and recently won a competition that awarded you with expensive design software and a new computer. Everything is looking up, so protecting the equipment is the last thing on your mind.

Unfortunately, your overconfidence doesn’t stop someone from breaking into your rented apartment and stealing your new laptop and software. Without insurance, it’ll be hard to recover from that loss.

The only way to overcome this common cognitive bias is by understanding that negative events can happen to anyone at any time, so you must protect yourself.

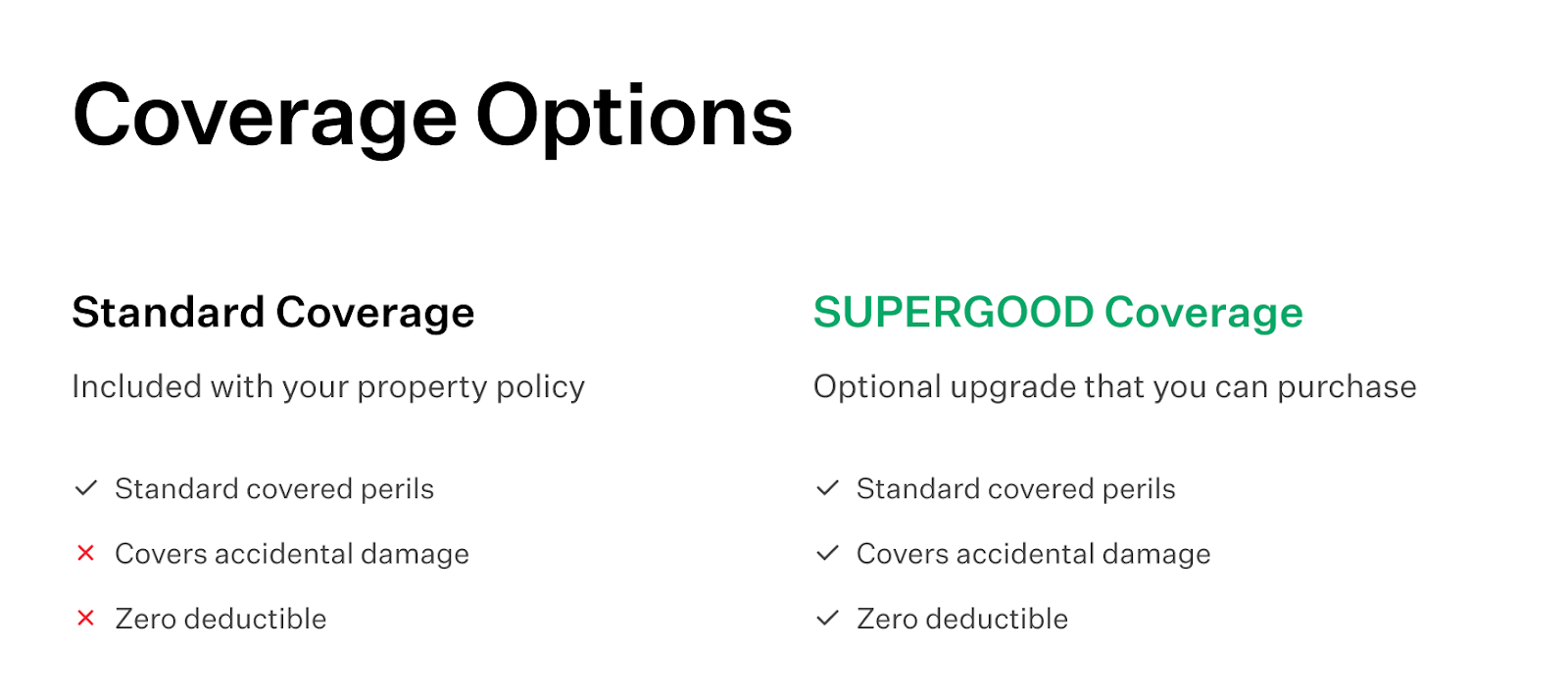

Goodcover’s renters insurance offers affordable plans to help you get back on your feet and protect your wearable tech and electronics from theft, fire, water damage, and more. Goodcover’s SUPERGOOD plan even covers accidental damage.

Status Quo Bias: I Like Everything Just The Way It Is

It’s normal to have a routine. Routine can signify stability. Although a healthy skepticism towards new ideas and situations is often appropriate, change is an inevitable part of life.

But if you’re constantly stuck in your ways in how you approach most things, you may be dealing with a status quo bias.

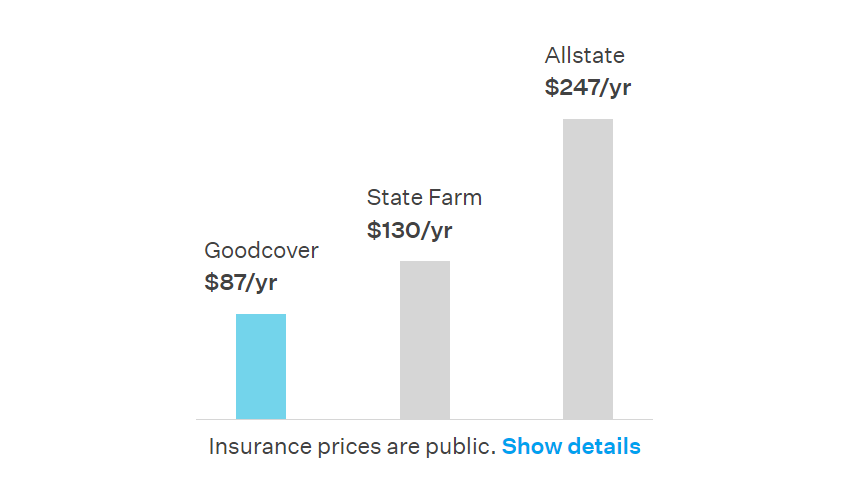

Believe it or not, the safety you find in choosing what you already know can be detrimental to you in more ways than one. For instance, it may keep you tied to one insurer every year, even if other renters insurance providers seem to offer better benefits at a lower price. You feel safer renewing your good ol’ policy.

A way to deal with that preconception is to weigh the pros and cons of sticking with your current provider. You can search online for an outsider's perspective on the matter and search online to see what other providers offer to ensure you’re getting the best bang for your buck.

Swapping to an insurer that offers similar coverage for lower premiums is easier than you might think. So it’s best to make a smart switch now and stay ahead long-term.

Sunk Cost Fallacy: But I’m Already Knee-Deep Into This

Suppose you recently spent a hefty sum on a beautiful vintage car. Driving it around is bliss, like gliding on your favorite couch. Unfortunately, it breaks down. And not just once — it happens constantly.

So you spend more money moving the car from one repair shop to another whenever something goes wrong. After all, you already drained your savings to get the dream car.

What’s that? The sunk cost fallacy at work.

Yes, sometimes we can’t help but feel attached when we’re invested in something. Loss aversion affects many human beings. Maybe we’re terrified at the thought of trying something new. Or perhaps we don’t want to admit defeat by just moving on.

But that doesn’t have to apply to every facet of life — sometimes, cutting your losses after realizing that what you’ve paid is a sunk cost is the better answer.

In the car example above, it may mean walking away from a car you love. But cheer up! You’ve saved tons of cash for a future where you end up with your dream car, but this time, everything works perfectly. You also get to invest in better auto insurance coverage in the future that protects you from further car-related sunk costs.

Self-Serving Bias: Me, Me, Me

Everyone has a soft spot for themselves — it’s human. A self-serving bias occurs when we conclude positive events are the result of our good qualities, smart decisions, or hard work. But we conclude negative events are due to external factors (e.g., bad luck or someone else’s lack of effort).

Have you ever met someone who firmly believes they’re a good driver? Since they've never had an accident, they might conclude they're observant, lawful, and quick-witted. Because of that self-assessment, they might opt out of collision coverage for their car.

Although they might be right, their beliefs are subjective and sometimes, plain wrong. Not to mention that even if they’re the best driver in the world, accidents are called accidents for a reason.

Sometimes, understanding there’s more to life than just ourselves can help overcome this systematic error in thinking. That means others will get it right and we’ll be wrong sometimes, and that’s okay. We can learn from our own mistakes, but most certainly, from other people’s behavior.

Anchoring Bias: I Know Enough Information To Make a Decision

The human brain has a tendency to stick with the first piece of information learned about a situation. That’s the anchoring bias.

For instance, let’s say you’re in the market for renters insurance. The first thing you do is ask your sister about premiums, and she tells you the average yearly premiums are $250.

When you finally get a quote from a provider, you see that the premiums are $150/year. Objectively, that's pretty high. But if you take what your sister told you at face value, it might seem like a bargain.

But is that enough information to make a lasting decision? In most cases, you may need more information. To avoid the pitfalls of the anchoring bias, you must first recognize you may be making decisions based on insufficient data and be willing to have an open mind to challenge your beliefs.

Approaching decisions with neutrality empowers you to create objective criteria that improve the outcomes of your decisions.

That’s not to say you shouldn’t listen to your sister when she tells you about renters insurance, but accompanying that with your own research might yield more options than you thought initially.

Confirmation Bias: I Believe It, So It Must Be True

Let’s say you rent a house in a fairly secure neighborhood. Personally, you’ve had zero experiences with theft, burglary, vandalism, and other property risks, so you can’t think of many reasons to get a renters policy.

Admittedly, you’ve heard recent reports about break-ins and people stealing packages. There’s nowhere with absolutely no crime, right? Besides, you’ve accidentally left your door unlocked multiple times, and nothing happened.

Confirmation bias is when we only look for information that agrees with our current beliefs. When reports contradict us and suggest risks, it’s easier to ignore and minimize them.

So, what can you do to overcome this bias? The first thing to understand is that, as people, we often get things wrong. Just as we can find ways to justify our decisions and validate our beliefs, we can test our own ideas for faults and adjust our thinking.

Moreover, seeking the intervention of an unbiased third-party can help keep the confirmation bias in check without invalidating your beliefs or ideas.

Avoid Biases in Insurance and Protect Yourself With Goodcover

Our decisions set the difference between peace of mind and bitter regret. Train your mind to go past the common cognitive biases so you can make better decisions about your insurance policies long-term.

Learn the basics of renters insurance and if you have an ill-fitting plan, Goodcover will cancel it for you to help you avoid gaps in coverage. Get a quote and experience better, member-driven renters coverage today.

Note: This post is for informational purposes; insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Dan Di Spaltro • 14 Jul 2025 • 15 min read

Commercial Insurance for Rental Properties: Landlord Guide

Team Goodcover • 26 Jun 2024 • 8 min read

How to Get Renters Insurance

Team Goodcover • 17 May 2024 • 3 min read

Renters Insurance Facts: Debunking Common Myths

Team Goodcover • 9 Feb 2024 • 5 min read

Does Renters Insurance Cover Personal Property Damage Caused by Police?

Team Goodcover • 19 Jan 2024 • 6 min read